DEF 14A: Definitive proxy statements

Published on February 29, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under 240.14a-12 |

OPKO Health, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply)

|

☒ |

No fee required |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

OPKO HEALTH, INC.

4400 Biscayne Blvd.

Miami, FL 33137

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MARCH 28, 2024

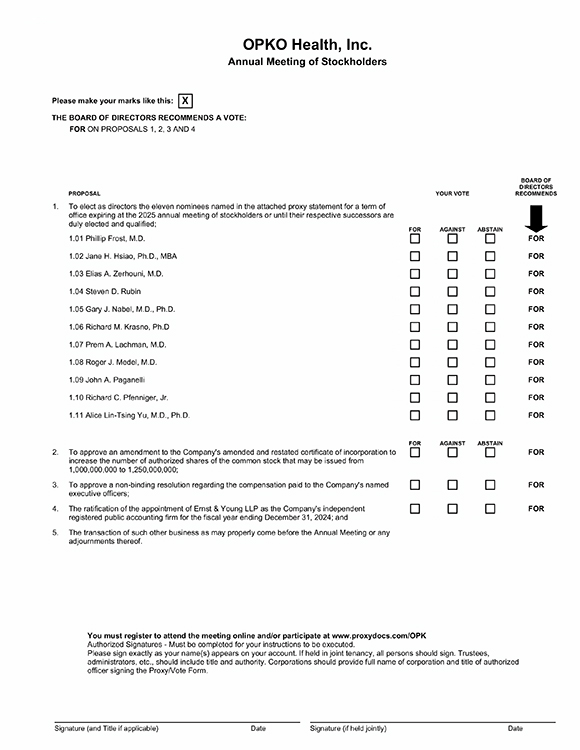

Notice is hereby given that the Annual Meeting of Stockholders (the “Annual Meeting”) of OPKO Health, Inc., a Delaware corporation (the “Company”), will be held on Thursday, March 28, 2024 beginning at 11:30 a.m., Eastern Time. The Annual Meeting will be held virtually via live webcast, during which you will be able to vote your shares electronically and submit your questions. At the Annual Meeting, we will ask you:

|

1. |

To elect as directors the eleven nominees named in the attached proxy statement for a term of office expiring at the 2025 annual meeting of stockholders or until their respective successors are duly elected and qualified; |

|

| 2. | To approve an amendment in the form set forth on Annex A to the Company’s proxy statement for the Annual Meeting (the “Charter Amendment”) to the Company’s amended and restated certificate of incorporation (the “Certificate of Incorporation”) to increase the number of authorized shares of the Company’s common stock, par value $0.01 per share (“common stock”), that may be issued from 1,000,000,000 to 1,250,000,000; | |

| 3. | To approve a non-binding advisory resolution regarding the compensation paid to the Company’s named executive officers (“Say on Pay”); | |

| 4. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and | |

| 5. | To transact such other business as may properly come before the Annual Meeting or any adjournments thereof. | |

Holders of record of our common stock at the close of business on Tuesday, February 13, 2024, will be entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. On or about February 29, 2024, the Company began mailing to stockholders of record as of February 13, 2024, a Notice of Annual Meeting, this proxy statement, the accompanying form of proxy, and our Annual Report to Stockholders for our fiscal year ended December 31, 2023 (“fiscal 2023”).

Whether or not you plan to participate in the Annual Meeting, it is important that you vote your shares. Regardless of the number of shares you own, please promptly vote your shares by telephone or Internet prior to the Annual Meeting or by marking, signing and dating the proxy card and returning it to the Company in the postage paid envelope provided. Should you participate in the live webcast, you may, if you wish, withdraw your proxy and vote your shares on the Internet during the Annual Meeting.

| By Order of the Board of Directors, | |

|

|

|

Steven D. Rubin Executive Vice President – Administration |

Miami, Florida

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on March 28, 2024

The Proxy Statement and 2023 Annual Report are available at www.opko.com.

OPKO HEALTH, INC.

PROXY STATEMENT FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

THURSDAY, March 28, 2024

This proxy statement is being made available to you by the Board of Directors (the “Board”) of OPKO Health, Inc., a Delaware corporation (the “Company,” “OPKO,” or “we,” “us” or “our”) in connection with the solicitation of proxies to be voted at the Annual Meeting of Stockholders of the Company on Thursday, March 28, 2024, beginning at 11:30 a.m., Eastern Time, and all adjournments thereof (the “Annual Meeting”). The 2024 Annual Meeting will be a virtual meeting of stockholders to be held solely as a live webcast over the Internet at www.proxydocs.com/OPK. There will not be a physical location for the Annual Meeting. At the Annual Meeting, the items of business to be voted on are:

|

1. |

To elect as directors the eleven nominees named in the attached proxy statement for a term of office expiring at the 2025 annual meeting of stockholders or until their respective successors are duly elected and qualified; |

|

| 2. | To approve an amendment in the form set forth on Annex A to the Company’s proxy statement for the Annual Meeting (the “Charter Amendment”) to the Company’s amended and restated certificate of incorporation (the “Certificate of Incorporation”) to increase the number of authorized shares of the Company’s common stock, par value $0.01 per share (“common stock”), that may be issued from 1,000,000,000 to 1,250,000,000. | |

| 3. | To approve a non-binding advisory resolution regarding the compensation paid to the Company’s named executive officers (“Say on Pay”); | |

| 4. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; and | |

| 5. | To transact such other business as may properly come before the Annual Meeting or any adjournments thereof. | |

Our Board has fixed the close of business on Tuesday, February 13, 2024, as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. As of that date, there were issued and outstanding 696,991,677 shares of our common stock. The holders of our common stock are entitled to one vote for each outstanding share held by them on all matters submitted to our stockholders.

On or about February 29, 2024, the Company began mailing a Notice of Annual Meeting, this proxy statement, the accompanying form of proxy, and our Annual Report to Stockholders for our fiscal year ended December 31, 2023 (“fiscal 2023”) to stockholders of record as of February 13, 2024.

Voting Procedure

You will be able to participate in the Annual Meeting online and submit your questions during the meeting by visiting www.proxydocs.com/OPK and registering in advance. To participate in the Annual Meeting, you will need the control number included on your proxy card or on the instructions that accompanied your proxy materials. Upon completion of your registration, you will receive further instructions via email, including your unique links that will allow you access to the Annual Meeting. Please be sure to follow instructions found on your proxy card and/or voting instruction form and subsequent instructions that will be delivered to you via email. You also will be able to vote your shares electronically at the Annual Meeting. Stockholders will be able to listen, vote and submit questions from their home via the Internet or from any remote location with Internet connectivity. The meeting webcast will begin promptly at 11:30 a.m. Eastern Time. We encourage you to access the meeting prior to the start time. Online access will begin at 11:15 a.m. Eastern Time. We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during the check-in time or meeting time, or if you have any questions regarding how to use the virtual meeting platform, please call the technical support number that will be posted on the virtual shareholder meeting login email. Technical support will be available beginning at 10:30 a.m. on March 28, 2024 and will remain available throughout the duration of the meeting. Information related to technical assistance will be provided in the email with the sign-in instructions you should receive following your successful registration.

The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong Internet connection wherever they intend to participate in the meeting. Participants should also give themselves plenty of time to dial-in to the conference call or log in and ensure that they can hear audio prior to the start of the meeting.

If you wish to submit a question, you may do so by visiting www.proxydocs.com/OPK and registering for the Annual Meeting. If you want to submit a question before the meeting, you may log into www.proxydocs.com/OPK, go to the registration page and enter the control number found on your proxy card, or voting instruction form. Once past the login screen, click in the box in the Question for Management section, type in your question, and click “Submit.” Alternatively, if you want to submit your question during the live meeting, you may do so by following the emailed instructions you will receive following your successful registration.

Questions submitted and which are pertinent to meeting matters will be answered during the meeting, subject to time constraints. Questions or comments that are not related to the proposals under discussion, are about personal concerns not reasonably shared by all of our stockholders generally, or use blatantly offensive language may be ruled out of order and will not be answered. Additionally, the Company may not be able to answer multiple questions submitted by the same stockholder. The questions and answers will be available as soon as practicable after the meeting and will remain available until one week after posting.

If you encounter any technical difficulties accessing the virtual meeting during the check-in time or meeting time, or if you have any questions regarding how to use the virtual meeting platform, please call the technical support number that will be included in the email sent one (1) hour prior to the Annual Meeting. Technical support will be available starting at 10:30 a.m. on March 28, 2024 and will remain available throughout the duration of the meeting.

Quorum and Voting at the Annual Meeting

A nominee for director will be elected to the Board if the votes cast in favor of a nominee by the holders of shares of our common stock present or represented and entitled to vote on the nomination at the Annual Meeting at which a quorum is present exceed the votes cast against a nominee. The Charter Amendment will be approved if the votes cast in favor of the proposal by the holders of shares of our common stock present or represented and entitled to vote on the proposal at the Annual Meeting at which a quorum is present exceed the votes cast against the proposal. In addition, the advisory vote on the Say on Pay proposal will be approved if the votes cast in favor of the proposal by the holders of shares of our common stock present or represented and entitled to vote on the proposal at the Annual Meeting at which a quorum is present exceed the votes cast against the proposal. Because your vote on the Say on Pay proposal is advisory, it will not be binding on the Board or the Company. However, the Compensation Committee of the Board will take into account the outcome of the Say on Pay vote when considering future executive compensation arrangements. The vote to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 will be approved if the votes cast in favor of the proposal by the holders of shares of our common stock present or represented and entitled to vote on the proposal at the Annual Meeting at which a quorum is present exceed the votes cast against the proposal. Any other matter that may be submitted to a vote of our stockholders at the Annual Meeting will be approved if the number of shares of common stock voted for the proposal exceed the votes cast against the proposal, unless such matter is one for which a greater vote is required by law or our Certificate of Incorporation or our amended and restated bylaws (the “Amended and Restated Bylaws”).

The presence, in person via participation in the virtual meeting or by proxy, of holders of a majority of our outstanding common stock entitled to vote constitutes a quorum at the Annual Meeting. Shares of our stock represented by proxies that reflect abstentions will be counted for the purpose of determining the existence of a quorum at the Annual Meeting, but will have no effect on the approval of the election of directors, the Charter Amendment proposal, the Say on Pay proposal, or the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

Shares of stock represented by proxies that reflect “broker non-votes” (i.e., stock represented at the Annual Meeting by proxies held by brokers or nominees as to which (i) the brokers or nominees have not received voting instructions from the beneficial owners of such shares and (ii) the brokers or nominees do not have the discretionary voting power on a particular matter) will be counted for the purpose of determining the existence of a quorum at the Annual Meeting because brokers have discretion to vote on at least one proposal at the Annual Meeting. A broker does not have the discretion to vote on the election of directors, the Charter Amendment proposal, or the non-binding Say on Pay proposal. A broker non-vote will have no effect on the approval of the election of directors, the Charter Amendment proposal, or the Say on Pay proposal. A broker has the discretion to vote on the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; therefore, if the broker exercises its discretion to vote on the proposal to ratify the appointment of Ernst & Young LLP as independent registered public accounting firm for the fiscal year ending December 31, 2024, its vote will be counted for purposes of determining the outcome of that proposal.

Any stockholder giving a proxy will have the right to revoke it at any time prior to the time it is voted. A proxy may be revoked by: (i) written notice to us on the date of or prior to the Annual Meeting at our executive offices located at 4400 Biscayne Blvd., Miami, Florida 33137, attention: Secretary; (ii) execution of a subsequent proxy; (iii) participating and voting electronically at the Annual Meeting by completing a ballot online during the live webcast; or (iv) re-voting by telephone or by Internet prior to the meeting (only your latest telephone or Internet vote will be counted). Participation at the Annual Meeting will not automatically revoke your proxy. If your shares are held in the name of a broker or nominee, you must follow the instructions of your broker or nominee to revoke a previously given proxy. All shares of our stock represented by effective proxies will be voted at the Annual Meeting or at any adjournment thereof. Unless otherwise specified in the proxy, shares of our stock represented by proxies will be voted: (i) FOR the election of the Board’s nominees for directors; (ii) FOR the Charter Amendment proposal; (iii) FOR the approval of the Say on Pay proposal; (iv) FOR the proposal to ratify the appointment of Ernst & Young, LLP, an independent registered public accounting firm, as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2024; and (v) in the discretion of the proxy holders with respect to such other matters as may properly come before the Annual Meeting.

Our executive offices are located at 4400 Biscayne Blvd., Miami, Florida 33137.

Security Ownership of Certain Beneficial Owners and Management

The following table contains information regarding the beneficial ownership of our common stock, which is our only outstanding class of voting securities, as of February 29, 2024 held by (i) each stockholder known by us to beneficially own more than 5% of the outstanding shares of common stock; (ii) our directors and director nominees; (iii) our Named Executive Officers as defined in the paragraph preceding the Summary Compensation Table contained elsewhere in this proxy statement and our current executive officers; and (iv) all current directors and executive officers as a group. Except where noted, all holders listed below have sole voting power and investment power over the shares beneficially owned by them. Unless otherwise noted, the address of each person listed below is c/o OPKO Health, Inc., 4400 Biscayne Blvd., Miami, FL 33137.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days. In computing the number of shares beneficially owned by a person or entity and the percentage ownership of that person or entity in the table below, all shares subject to options or other derivative securities held by such person or entity were deemed outstanding if such securities are currently exercisable, or exercisable or would vest based on applicable vesting conditions within 60 days of February 29, 2024. These shares were not deemed outstanding, however, for the purpose of computing the percentage ownership of any other person or entity.

|

Amount and Nature |

|||||||

|

Name and Address of |

Beneficial |

Percentage of |

|||||

|

Beneficial Owner |

Class of Security |

Ownership |

Class** |

||||

|

Directors and Named Officers: |

|||||||

|

Phillip Frost, M.D. |

Common Stock |

244,851,853 |

(1) |

34.99% |

|||

|

CEO & Chairman of the Board |

|||||||

|

Jane H. Hsiao, Ph.D., MBA |

Common Stock |

35,777,284 |

(2) |

5.11% |

|||

|

Vice Chairman of the Board & Chief Technical Officer |

|||||||

|

Elias A. Zerhouni, M.D., Ph.D. |

Common Stock |

20,426,145 |

(3) |

2.93% |

|||

|

Vice Chairman of the Board and President |

|||||||

|

Steven D. Rubin |

Common Stock |

8,512,732 |

(4) |

1.22% |

|||

|

Executive Vice President – Administration and Director |

|||||||

|

Adam Logal |

Common Stock |

2,004,162 |

(5) |

* |

|||

|

Senior Vice President, Chief Financial Officer, Chief Accounting Officer, and Treasurer |

|||||||

|

Gary J. Nabel, M.D., Ph.D. |

Common Stock |

20,535,711 |

(6) |

2.95% |

|||

|

Chief Innovation Officer |

|||||||

|

Alexis Borisy, Director |

Common Stock |

392,612 |

(7) |

* |

|||

|

John A. Paganelli, Director |

Common Stock |

593,515 |

(8) |

* |

|||

|

Richard C. Pfenniger, Jr., Director |

Common Stock |

645,000 |

(9) |

* |

|||

|

Richard M. Krasno, Ph.D., Director |

Common Stock |

283,333 |

(10) |

* |

|||

|

Alice Lin-Tsing Yu, M.D., Ph.D., Director |

Common Stock |

266,490 |

(11) |

* |

|||

|

Prem A. Lachman, M.D., Director |

Common Stock |

100,000 |

(12) |

* |

|||

|

Roger J. Medel, M.D., Director |

Common Stock |

100,000 |

(13) |

* |

|||

|

All Executive Officers and Directors as a group |

Common Stock |

334,488,837 |

47.26% |

||||

|

(13 persons) |

|||||||

|

More than 5% Owners: |

|||||||

|

Frost Gamma Investments Trust |

Common Stock |

208,868,225 |

(14) |

29.97% |

|||

|

Bruce C. Holbrook |

Common Stock |

40,380,104 |

(15) |

5.80% |

|||

|

1107 Botetourt Gardens |

|||||||

|

Norfolk, VA 23507 |

|||||||

|

Coe M. Magruder |

Common Stock |

39,824,918 |

(16) |

5.80% |

|||

|

2200 Pennsylvania Avenue, Suite 400 East |

|||||||

|

Washington, DC 20037 |

|||||||

|

The Vanguard Group |

Common Stock |

39,751,293 |

(17) |

5.14% |

|||

|

100 Vanguard Blvd. |

|||||||

|

Malvern, PA 19355 |

|||||||

|

* |

Less than 1% |

|

** |

Percentages based upon 696,991,677 shares of our common stock issued and outstanding at February 29, 2024. |

|

(1) |

Includes 208,868,225 shares of common stock held by Frost Gamma Investments Trust. Also includes options to purchase 2,787,500 shares of common stock held by Dr. Frost. Dr. Frost is the trustee and Frost Gamma Limited Partnership is the sole and exclusive beneficiary of Frost Gamma Investments Trust. Dr. Frost is one of two limited partners of Frost Gamma Limited Partnership. The general partner of Frost Gamma Limited Partnership is Frost Gamma Inc. and the sole stockholder of Frost Gamma, Inc. is Frost-Nevada Corporation. Dr. Frost is also the sole stockholder of Frost-Nevada Corporation. The number of shares included above also includes 30,127,177 shares of common stock owned directly by Frost Nevada Investments Trust, of which the Dr. Frost is the trustee and Frost-Nevada, L.P. is the sole and exclusive beneficiary. Dr. Frost is one of seven limited partners of Frost-Nevada, L.P. and the sole shareholder of Frost-Nevada Corporation, the sole general partner of Frost-Nevada, L.P. Does not include shares of 2,851,830 common stock held by the Phillip and Patricia Frost Philanthropic Foundation, Inc., of which Dr. Frost is one of three directors. Dr. Frost has sole voting and dispositive power over 244,851,853 shares of the Company’s common stock reported as beneficially owned. |

|

(2) |

Includes options to purchase 2,650,000 shares of common stock. Also includes 5,127,404 shares of common stock held by Hsu Gamma Investment, L.P., for which Dr. Hsiao serves as General Partner. |

|

(3) |

Includes options to purchase 8,731 shares of common stock. Also includes 20,327,814 shares of common stock held by the Zerhouni Irrevocable Trust, for which the independent trustee has delegated investment authority to Dr. Zerhouni. The shares of common stock held by the Zerhouni Irrevocable Trust are for the benefit of the Dr. Zerhouni and his children and descendants, as well as certain qualifying charitable organizations, and for which an independent trustee has been appointed. Dr. Zerhouni's beneficial ownership excludes 19,777,514 shares of common stock held by the EAZ Zeraz Trust, which are for the benefit of Dr. Zerhouni’s spouse and descendants, as well as certain qualifying charitable organizations, and an independent trustee has been appointed. Dr. Zerhouni does not have either voting or dispositive power over the securities held by the EAZ Zeraz Trust. The Zerhouni Irrevocable Trust and the EAZ Zeraz Trust own in the aggregate approximately 5.75% of the shares of Company’s common stock. |

|

(4) |

Includes options to purchase 2,325,000 shares of common stock. |

|

(5) |

Includes options to purchase 1,825,000 shares of common stock. |

|

(6) |

Includes options to purchase 8,731 shares of common stock. Also includes 351,442 shares of common stock held directly by the Nabel Family Investments LLC, for which Dr. Nabel serves as the authorized agent, and 19,912,459 shares held by the EGN 2021 Trust, for which Dr. Nabel serves as an investment advisor together with an independent trustee, which shares are for the benefit of Dr. Nable and his descendants. Excludes 19,912,459 shares of common stock held by the GJN 2021 Trust, which shares are for the benefit of Dr. Nabel’s spouse and descendants, and Dr. Nabel’s spouse serves as co-trustee together with an independent trustee. The GJN 2021 Trust and the EGN 2021 Trust own in the aggregate approximately 5.71% of the shares of common stock outstanding. Dr. Nabel disclaims beneficial ownership of the shares of common stock owned by each of the GJN 2021 Trust and the EGN 2021 Trust, except to the extent of his pecuniary interest therein. Also excludes 220,689 shares of common stock held by Dr. Nabel’s spouse, for which Dr. Nabel disclaims beneficial ownership, except to the extent of his pecuniary interest therein. |

|

(7) |

Includes options to acquire 80,000 shares of common stock. |

|

(8) |

Includes options to acquire 200,000 shares of common stock. Also includes 9,175 shares of common stock held by Mr. Paganelli’s spouse. |

|

(9) |

Includes options to acquire 320,000 shares of common stock. |

|

(10) |

Includes options to acquire 180,000 shares of common. Also includes 103,333 shares of common stock held by the Richard M. Krasno Trust, for which Richard M. Krasno is Trustee. |

|

(11) |

Includes options to acquire 200,000 shares of common stock. |

|

(12) |

Includes options to acquire 100,000 shares of common stock. |

|

(13) |

Includes options to acquire 100,000 shares of common stock. |

|

(14) |

The Frost Gamma Investments Trust has sole voting and dispositive power over 208,868,225 shares of the Company’s common stock. Does not include 3,068,951 shares of common stock held directly by Dr. Frost, 2,787,500 options to purchase shares of common stock held by Dr. Frost, 30,127,177 shares of common stock owned directly by Frost Nevada Investments Trust, or 2,851,830 shares of common stock held by the Phillip and Patricia Frost Philanthropic Foundation, Inc. |

|

(15) |

Based solely on information reported on Schedule 13D filed by the stockholder on June 29, 2023 and information received from the stockholder on January 23, 2024. According to the information reported in the Schedule 13D, Mr. Holbrook has sole voting power and sole dispositive power over 274,776 shares of the Company’s common stock held individually by Mr. Holbrook, shared voting power and shared dispositive power over 40,105,328 shares of the Company’s common stock, which includes (i) 19,777,514 shares of the Company’s common stock held directly by the EAZ Zeraz Trust, for which Mr. Holbrook serves as the sole trustee, and (ii) 20,327,814 shares of the Company’s common stock held directly by the Zerhouni Irrevocable Trust, for which Mr. Holbrook serves as the sole trustee and has delegated investment authority to Dr. Zerhouni. |

|

(16) |

Based solely on information reported on Schedule 13D filed by the stockholder on June 29, 2023. According to the information reported in the Schedule 13D, Mr. Magruder has no sole voting power or sole dispositive power over any shares of the Company’s common stock and shared voting power and shared dispositive power over 39,824,918 shares of the Company’s common stock, which includes (i) 19,912,459 shares of the Company’s common stock held directly by the EGN 2021 Trust, for which Mr. Magruder serves as the sole trustee, and as investment advisor together with Dr. Gary Nabel, and (ii) 19,912,459 shares of the Company’s common stock held directly by the GJN 2021 Trust, for which Mr. Magruder serves as co-trustee together with Dr. Elizabeth Nabel. Mr. Magruder disclaims beneficial ownership of these shares. |

|

(17) |

Based solely on information reported on Schedule 13G/A filed by the stockholder on February 13, 2024. According to the information reported in the Schedule 13G/A, The Vanguard Group has no sole voting power over any shares of the Company's common stock, shared voting power over 300,561 shares of the Company’s common stock, sole dispositive power over 39,059,416 shares of the Company’s common stock, and shared dispositive power over 691,877 shares of the Company’s common stock. |

PROPOSAL ONE:

ELECTION OF DIRECTORS

Pursuant to the authority granted to our Board under Article III of our Amended and Restated Bylaws, the Board has fixed the number of directors constituting the entire Board at twelve; however, as Mr. Alexis Borisy is not standing for reelection, eleven directors have been nominated for election at the Annual Meeting. If elected, each nominee will hold office until the 2025 annual meeting of stockholders or until his or her successor is duly elected and qualified. Each stockholder of record on February 13, 2024 is entitled to cast one vote for each share of our common stock either in favor of or against the election of each nominee, or to abstain from voting on any or all nominees. Although management does not anticipate that any nominee will be unable or unwilling to serve as a director, in the event of such an occurrence, proxies may be voted in the discretion of the persons named in the proxy for a substitute designated by the Board, unless the Board decides to reduce the number of directors constituting the Board. Each nominee will be elected if the votes cast in favor of a nominee by the holders of shares of our common stock present or represented and entitled to vote at the Annual Meeting at which a quorum is present exceed the votes cast against a nominee.

NOMINEES FOR DIRECTOR

The following sets forth information provided by the nominees as of February 13, 2024. All of the nominees are currently serving as directors for the Company. All of the nominees have consented to serve if elected by our stockholders.

|

Year First |

||||||

|

Elected/ |

||||||

|

Name of Nominee |

Age |

Nominated |

Positions and Offices with the Company |

|||

| Phillip Frost, M.D. | 87 | 2007 | Chairman of the Board and Chief Executive Officer | |||

|

Jane H. Hsiao, Ph.D., MBA |

76 |

2007 |

Vice Chairman of the Board and Chief Technical Officer |

|||

| Elias A. Zerhouni, M.D. | 72 | 2022 | Vice Chairman of the Board and President | |||

| Steven D. Rubin | 63 | 2007 | Director and Executive Vice President-Administration | |||

| Gary J. Nabel, M.D., Ph.D. | 70 | 2022 | Director and Chief Innovation Officer | |||

| Richard M. Krasno, Ph.D. | 82 | 2017 | Director | |||

|

Prem A. Lachman, M.D. |

63 |

2021 |

Director |

|||

| Roger J. Medel, M.D. | 77 | 2020 | Director | |||

| John A. Paganelli | 89 | 2003 | Director | |||

|

Richard C. Pfenniger, Jr. |

68 |

2008 |

Director |

|||

| Alice Lin-Tsing Yu, M.D., Ph.D. | 80 | 2009 | Director |

Phillip Frost, M.D. Dr. Frost has been the Chief Executive Officer of the Company and Chairman of the Board since March 2007. Dr. Frost currently serves as a director for Cocrystal Pharma, Inc. (NASDAQ:COCP), a biotechnology company developing new treatments for viral diseases, and Non-Invasive Monitoring Systems, Inc. (OTC US:NIMU), a medical device company. He also currently serves on the board of Grove Bank & Trust and Morgan Solar. He has been a member of the Board of Trustees of the University of Miami since 1983 and was Chairman from 2001 to 2004. He is on the Advisory Board of the Shanghai Institute for Advanced Immunochemical Studies in China, is a trustee of the Miami Jewish Home for the Aged, and serves on the Executive Committee of the Board of Mount Sinai Medical Center. He serves as Chairman of Temple Emanu-El, Governor of Tel Aviv University and is a member of the Executive Committee of The Phillip and Patricia Frost Museum of Science. Dr. Frost was a Regent of the Smithsonian Institute from 2006 to 2010. From 1996 to 2009, he served as a director for Northrop Grumman (NYSE: NOC). Dr. Frost served as a director of Ladenburg Thalmann Financial Services Inc. from 2004 to 2006 and as Chairman from July 2006 until September 2018. Dr. Frost previously served as a director for Castle Brands (NYSE American:ROX). Dr. Frost had served as Chairman of the Board of Directors and Chief Executive Officer of IVAX Corporation (“IVAX”) from 1987 until its acquisition by Teva in January 2006. Dr. Frost was Chairman of the Board of Directors of Key Pharmaceuticals, Inc. from 1972 until its acquisition by Schering Plough Corporation in 1986. Dr. Frost was a Governor of the American Stock Exchange from 1992 to 2008 and Co-Vice Chairman from 2001 until its merger with the New York Stock Exchange.

Dr. Frost has successfully founded several pharmaceutical companies and overseen the development and commercialization of a multitude of pharmaceutical products. This, combined with his experience as a physician and chairman and/or chief executive officer of large pharmaceutical companies, has given him insight into virtually every facet of the pharmaceutical business and drug development and commercialization process. He is a demonstrated leader with keen business understanding and is uniquely positioned to help guide our Company through its transition from a development stage company into a successful, multinational biopharmaceutical and diagnostics company.

Jane H. Hsiao, Ph.D., MBA. Dr. Hsiao has served as Vice-Chairman and Chief Technical Officer of the Company since May 2007 and as a director since February 2007. Dr. Hsiao has served as Chairman of the Board of Non-Invasive Monitoring Systems, Inc. (OTC US:NIMU), a medical device company, since October 2008 and was named Interim Chief Executive Officer of Non-Invasive Monitoring Systems, Inc. in February 2012. Dr. Hsiao previously served as a director of Cocrystal Pharma, Inc. (NASDAQ:COCP), a biotechnology company developing new treatments for viral diseases, Neovasc, Inc. (NASDAQ:NVCN), a company developing and marketing medical specialty vascular devices, and Asensus Surgical, Inc. (NYSE American: ASXC), a medical device company. Dr. Hsiao served as the Vice Chairman-Technical Affairs of IVAX from 1995 to January 2006. Dr. Hsiao served as Chairman, Chief Executive Officer and President of IVAX Animal Health, IVAX’s veterinary products subsidiary, from 1998 to 2006.

Dr. Hsiao’s background in pharmaceutical sciences and strong technical expertise, as well as her senior management experience, allow her to play a leadership role in overseeing our product selection for development and providing strategies for approval by regulatory authorities. In addition, as director and/or chairman in the life sciences industry, she also has a keen understanding of the operational cost efficiencies and pharmaceutical market opportunities.

Elias A. Zerhouni, M.D. Dr. Zerhouni was appointed as President of the Company and Vice Chairman of the Board on May 9, 2022. Dr. Zerhouni had been the chairman and is the co-founder of ModeX Therapeutics Inc. (“ModeX”), a start-up biotechnology company focused on multi specific-immune therapies for cancer and viral diseases, from October 2020 until its acquisition by the Company in May 2022. He is a physician scientist in Imaging and Biomedical Engineering. He served as President of Global Research & Development and Executive Vice President of Sanofi (NASDAQ: SNY) from 2010 to 2018, as Senior Fellow for global health research at the Bill and Melinda Gates Foundation from 2009 to 2010 and as Presidential U.S. envoy for science and technology from 2009 to 2010. He was Director of the U.S. National Institutes of Health from 2002 to 2008, Executive Vice Dean and Dean for research at the Johns Hopkins School of Medicine from 1996 to 2002, and Professor of Radiology and Biomedical Engineering and chair of the department of Radiological Sciences. Dr. Zerhouni was elected to the National Academy of Medicine and to the National Academy of Engineering. He serves on the board of the Lasker Foundation, the Foundation for National Institutes of Health, and Research!America. He received the 2017 Scripps Executive of the Year Award for the pharmaceutical industry and the French Legion of Honor in 2008. Since 2009, Dr. Zerhouni has served as a director of the publicly traded Danaher Corporation (NYSE:DHR), a global science and technology innovator committed to helping its customers solve complex challenges and improving quality of life around the world. Since 2019, he has also served as a director of B-FLEXION Capital, a private, entrepreneurial investment firm.

Dr. Zerhouni’s has an extensive science background, and significant leadership and management expertise, all of which will positively inform his contributions to the Company and make him uniquely qualified to serve in his role as President and Vice Chairman of the Board.

Steven D. Rubin. Mr. Rubin has served as Executive Vice President – Administration since May 2007 and as a director of the Company since February 2007. Mr. Rubin currently serves on the board of directors of Red Violet, Inc. (NASDAQ:RDVT), a software and services company, Cocrystal Pharma, Inc. (NASDAQ:COCP), a publicly traded biotechnology company developing new treatments for viral diseases, Eloxx Pharmaceuticals, Inc. (NASDAQ:ELOX), a clinical stage biopharmaceutical company dedicated to treating patients suffering from rare and ultra-rare disease caused by premature termination codon nonsense mutations, and ChromaDex Corp. (NASDAQ:CDXC), a science-based, integrated nutraceutical company devoted to improving the way people age. Mr. Rubin previously served as a director of Neovasc, Inc. (NASDAQ:NVCN), a company that developed and marketed medical specialty vascular devices, Non-Invasive Monitoring Systems, Inc. (OTC US:NIMU), a medical device company, VBI Vaccines, Inc. (NASDAQ:VBIV), a biopharmaceutical company developing next generation vaccines, Cogint, Inc. (NASDAQ:COGT), now known as Fluent, Inc. (NASDAQ:FLNT), an information solutions provider focused on the data-fusion market, prior to the spin-off of its data and analytics operations and assets into Red Violet, Inc., Kidville, Inc. (OTCBB:KVIL), which operated large, upscale facilities, catering to newborns through five-year-old children and their families, and Castle Brands, Inc. (NYSE American:ROX), a developer and marketer of premium brand spirits.

Mr. Rubin brings extensive leadership, business, and legal experience, as well as tremendous knowledge of our business and the pharmaceutical industry generally, to the Board. He has advised pharmaceutical companies in several aspects of business, regulatory, transactional, and legal affairs for more than 25 years. His experience as a practicing lawyer, general counsel, management executive and board member to multiple public companies, including several pharmaceutical and life sciences companies, has given him broad understanding and expertise, particularly relating to strategic planning and acquisitions.

Gary J. Nabel, M.D., Ph.D. Dr. Nabel was appointed as Chief Innovation Officer of the Company and as a director on May 9, 2022. He also serves as Chief Executive Officer of ModeX. Dr. Nabel is the co-founder of ModeX and held the positions of President and CEO from October 2020 until its acquisition by the Company in May 2022. Dr. Nabel currently serves as a director of SIGA Technologies, Inc. (NASDAQ: SIGA), a commercial stage pharmaceutical company focused on providing solutions for unmet needs in health security, and Candel Therapeutics, Inc. (NASDAQ: CADL), a clinical stage biopharmaceutical company focused on developing and commercializing viral immunotherapies to help patients fight cancer. Prior to joining ModeX, Dr. Nabel served as Chief Scientific Officer, Global Research and Development, and Head of the North American Research & Development Hub at Sanofi until his retirement in 2020. In addition to serving as Senior Vice President for Sanofi, Dr. Nabel also oversaw the Breakthrough Lab, which developed the first trispecific antibodies now in development for HIV, as well as cancer immunotherapies and novel vaccines. An author of more than 450 scientific publications, Dr. Nabel joined Sanofi in 2012 from the National Institutes of Health, where he served as Director of the Vaccine Research Center (VRC) from 1999 to December 2012, during which time, he provided overall direction and scientific leadership of the basic, clinical, and translational research activities and guided development of novel vaccine strategies against HIV, universal influenza, Ebola and emerging infectious disease viruses. Dr. Nabel graduated magna cum laude from Harvard College in 1975 and continued his graduate studies at Harvard, completing his Ph.D. in 1980 and his M.D. two years later, followed by a post-doctoral fellowship with David Baltimore at the Whitehead Institute. Dr. Nabel was elected to the National Academy of Medicine in 1998. Among his many other honors, Dr. Nabel received the Amgen Scientific Achievement Award from the American Society for Biochemistry and Molecular Biology, the Health and Human Services Secretary’s Award for Distinguished Service, and is a fellow of the American Association of Physicians, and the American Academy of Arts Sciences.

Dr. Nabel’s broad experience and expertise within the pharmaceutical and biotech industries, as well as his history of leadership within the National Institutes of Health, will provide the Board with valuable insights into many aspects of our business, including with respect to our science based and research and development programs.

Richard M. Krasno, Ph.D. Dr. Krasno has served on the Company’s Board of Directors since February 2017. Dr. Krasno has been a private investor in companies for the past six years. Dr. Krasno also served as the executive director of the William R. Kenan, Jr. Charitable Trust (the “Trust”) from 1999 to 2014, and from 1999 to 2010, as President of the four affiliated William R. Kenan, Jr. Funds. Prior to joining the Trust, Dr. Krasno was the President of the Monterey Institute of International Studies in Monterey, California. From 2004 to 2012, Dr. Krasno also served as a Director of the University of North Carolina Health Care System and served as chairman of its board of directors from 2009 to 2012. From 1981 to 1998, he served as President and Chief Executive Officer of the Institute of International Education in New York. He also served as Deputy Assistant Secretary of Education in Washington, D.C. from 1979 to 1980. Dr. Krasno currently serves as a director of BioCardia, Inc. (NASDAQ: BCDA). He previously served as a director of Ladenburg Thalmann (NYSE American:LTS) and Castle Brands, Inc. (NYSE American:ROX). Dr. Krasno holds a Bachelor of Science from the University of Illinois and a Ph.D. from Stanford University.

Dr. Krasno’s pertinent skills and experience, including his financial literacy and expertise, managerial experience and the knowledge he has attained through his service as a director of publicly-traded corporations have added and will continue to add valuable insight to our Board on a wide range of business and operational issues.

Prem A. Lachman. M.D. Dr. Lachman was appointed to the Company’s Board of Directors in March 2021. Dr. Lachman is a healthcare investment manager with more than 35 years of experience in portfolio management, biopharmaceutical investment research and healthcare investment banking. Additionally, Dr. Lachman was very active in gastroenterology research during his tenure at Mount Sinai. Dr. Lachman founded Maximus Capital, LLC in 2001 and currently serves as its general partner. Dr. Lachman previously served as the general partner of The Galleon Group from 1998 to 2001 and as Managing Director, Investment Research at Goldman Sachs & Co. from 1989 to 1998. Dr. Lachman is a Directors Council board member of the New York Museum of Modern Art, a board member of the New York Metropolitan Opera, and a board member of the Department of Surgery at Mount Sinai Medical Center in New York.

With his significant experience in the healthcare and investment management, Dr. Lachman brings unique and interesting skills to the Board which we anticipate will be significant to the Company’s financial operations.

Roger J. Medel, M.D. Dr. Medel has served on the Company’s Board of Directors since December 2020. Dr. Medel is the co-founder of Pediatrix Medical Group, Inc., formerly known as MEDNAX, Inc., (NYSE:MD), a national health solutions partner comprised of the nation’s leading providers of physician services, and has served as a director of Pediatrix Medical Group, Inc. from 1979 to March 2023. Dr. Medel served as President of Pediatrix Medical Group, Inc. from 1979 until May 2000 and again from March 2003 until May 2004. He served as Chief Executive Officer of Pediatrix Medical Group, Inc. from 1979 until December 2002, and again from March 2003 until July 2020 when he retired. Dr. Medel has served as a member of the Board of Trustees of the Dana Farber Cancer Institute, Inc. since January 2011 and also has served on the Board of Directors of Schweiger Dermatology Group, a privately held, private equity backed, multi-state dermatology practice, since 2014. He previously served on the Board of Directors of InnovaCare Health, a privately held, private equity backed, healthcare company. He currently serves on the Advisory Committee of MBF Healthcare Partners and, from June 2006 to April 2009, served on the Board of Directors of MBF Healthcare Acquisition Corp. He was a member of the Board of Trustees of the University of Miami from January 2004 to February 2012. Dr. Medel actively participates as a member of several medical and professional organizations.

As the former Chief Executive Officer and founder of a major public healthcare company, Dr. Medel’s experience aligns with the goals of the Company and his role as a director.

John A. Paganelli. Mr. Paganelli has served on the Company’s Board of Directors since December 2003. Mr. Paganelli served as the Company’s Interim Chief Executive Officer and Secretary from June 29, 2005 through March 27, 2007, the Company’s Interim Chief Financial Officer from June 29, 2005 through July 1, 2005, and Chairman of our Board from December 2003 through March 27, 2007. Mr. Paganelli served as President and Chief Executive Officer of Transamerica Life Insurance Company of New York from 1992 to 1997. Mr. Paganelli is the founder of and had been a partner in RFG Associates, a financial planning organization, from 1987 through 2021. Mr. Paganelli is also the Managing Partner of Pharos Systems Partners, LLC, an investment company, and past Chairman of the Board of Pharos Systems International, a software company. He was Vice President and Executive Vice President of PEG Capital Management, an investment advisory organization, from 1987 until 2000. Mr. Paganelli also serves as a director of Western New York Energy, LLC and was on the Board of Trustees of Paul Smith’s College from 2011 to 2019.

With his significant experience in investment management and operations, Mr. Paganelli is able to add valuable expertise and insight to our Board on a wide range of operational and financial issues. As one of the longest tenured members of our Board, he also has substantial knowledge and familiarity regarding our historical operations.

Richard C. Pfenniger, Jr. Mr. Pfenniger is a private investor and has served as a director of the Company since January 2008. During his career, Mr. Pfenniger has served as an executive officer of several companies, including as Chief Executive Officer and President of Continucare Corporation, a provider of primary care physician and practice management services, from 2003 until 2011, where he also served as Chairman of the Board of Directors of Continucare Corporation from 2002 until 2011. Previously, Mr. Pfenniger served as the Chief Executive Officer and Vice Chairman of Whitman Education Group, Inc. from 1997 through June 2003. Prior to joining Whitman, he served as the Chief Operating Officer of IVAX from 1994 to 1997, and, from 1989 to 1994, he served as the Senior Vice President-Legal Affairs and General Counsel of IVAX Corporation. Prior thereto he was engaged in the private practice of law. Mr. Pfenniger currently serves as a director of Asensus Surgical, Inc. (NYSE American: ASXC), a medical device company, Cocrystal Pharmaceuticals, Inc. (NASDAQ:COCP), a clinical stage biotechnology company, Fluent, Inc. (NASDAQ:FLNT), a company utilizing proprietary data science to assist global brands in customer acquisition, and GeneDx Holding Corp. (NASDAQ:WGS), a patient-centered health intelligence company dedicated to advancing healthcare through data-driven insights. He also serves as the Vice Chairman of the Board of Trustees and as a member of the Executive Committee of the Phillip and Patricia Frost Museum of Science. Mr. Pfenniger previously served as a director of GP Strategies Corporation (NYSE:GPX), a corporate education and training company, BioCardia, Inc. (NASDAQ: BCDA), clinical-stage regenerative medicine company developing novel therapeutics for cardiovascular diseases, and Wright Investors’ Services Holdings, Inc. (OTC US:IWSH), an investment management and financial advisory firm.

As a result of Mr. Pfenniger’s multi-faceted experience as chief executive officer, chief operating officer and general counsel, he is able to provide valuable business, leadership, and management advice to the Board in many critical areas. In addition, Mr. Pfenniger’s knowledge of the pharmaceutical and healthcare business has given him insights on many aspects of our business and the markets in which we operate. Mr. Pfenniger also brings financial expertise to the Board, including through his service as Chairman of our Audit Committee.

Alice Lin-Tsing Yu, M.D., Ph.D. Dr. Yu has served on the Company’s Board of Directors since April 2009. She has been a Professor of Pediatrics for the University of California in San Diego since 1994. Previously, she was the Chief of Pediatric Hematology Oncology at the University of California in San Diego. From 2003 to May 2013, Dr. Yu served as a Distinguished Research Fellow and Associate Director at the Genomics Research Center, Academia Sinica, in Taiwan. Dr. Yu has also served in several government-appointed advisory positions and is a member of numerous scientific committees and associations. She has been a long-time member of the Children’s Oncology Group in the United States, serving on the Steering Committee of Neuroblastoma. Dr. Yu currently serves as a director of two private entities, Apexcella Biomedical Inc. and UCT Bioscience, Inc. She was honored with the Pediatric Oncology Award by the American Society of Clinical Oncology (ASCO) in 2020.

Dr. Yu is an accomplished physician, professor, and researcher who brings a unique perspective to our Board on a variety of healthcare related issues. As a pioneer in immunotherapy of neuroblastoma, Dr. Yu was instrumental in developing a monoclonal anti-GD2 (Dinutuximab) from IND through early phase studies and phase III trials, and facilitating its FDA approval on March 10, 2015. The insight and experience gained from her distinguished record of achievement at several highly respected academic medical institutions, as well as her experience as a practicing physician, continue to be valuable to our efforts to develop and commercialize our pipeline of diagnostic and therapeutic products.

OUR BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES NAMED ABOVE.

Identification of Executive Officers

Our Executive Officers are Phillip Frost, Jane H. Hsiao, Elias A. Zerhouni, and Steven D. Rubin, for whom age, title and biographical information is included above under “Nominees for Election of Directors”, as well as Adam Logal, whose age, title and biographical information are set forth below:

|

Name of Executive Officer |

Age |

Position and Offices with the Company |

|||

|

Adam Logal |

45 |

Senior Vice President, Chief Financial Officer, Chief Accounting Officer, and Treasurer |

|||

Adam Logal. Mr. Logal has served as OPKO’s Senior Vice President, Chief Financial Officer, Chief Accounting Officer, and Treasurer since March 2014, Vice President of Finance, Chief Accounting Officer and Treasurer from July 2012 until March 2014, and Director of Finance, Chief Accounting Officer and Treasurer from March 2007 until July 2012. In addition, Mr. Logal also served as President of GeneDx, LLC, a former subsidiary of OPKO, from July 2020 to June 2021. He currently serves as chairman of the board of directors of Xenetics Biosciences, Inc. (NASDAQ:XBIO), a clinical-stage biopharmaceutical company focused on discovery, research and development of next-generation biologic drugs and novel orphan oncology therapeutics. He previously served on the board of directors of VBI Vaccines, Inc. (NASDAQ:VBIV) from April 2014 until 2018. From 2002 to 2007, Mr. Logal served in senior management of Nabi Biopharmaceuticals, a publicly traded, biopharmaceutical company engaged in the development and commercialization of proprietary products. Mr. Logal held various positions of increasing responsibility at Nabi Biopharmaceuticals, last serving as Senior Director of Accounting and Reporting.

Identification of Certain Other Officers

Set forth below are certain other officers important to our organization and biographical information for each of them:

Charles W. Bishop, PhD. Dr. Bishop, age 72, has served as Chief Executive Officer of OPKO Renal since our acquisition of Cytochroma Inc. in March 2013. Dr. Bishop was responsible for the successful development and FDA approval of Rayaldee (calcifediol) Extended-Release Capsules. Dr. Bishop had served as President and Chief Executive Officer of Cytochroma since June 2006. Dr. Bishop co-founded Proventiv Therapeutics, LLC in September 2005 for which he served as President until June 2006 when Proventiv and its lead drug, Rayaldee™, were acquired by Cytochroma. During the period from September 1987 to June 2005, Dr. Bishop held various senior management positions at Bone Care International, Inc. (“Bone Care”), a public specialty pharmaceutical company focused on developing and commercializing vitamin D hormone therapies. Dr. Bishop’s positions with Bone Care included President, Chief Executive Officer, Director, Executive Vice President of Research and Development, and Chief Scientific Officer. Bone Care was acquired for $720 million by Genzyme Corporation in July 2005. Prior to joining Bone Care, Dr. Bishop held various management positions in the Health Care Division of the Procter & Gamble Company. Dr. Bishop completed a four-year National Institutes of Health Postdoctoral Fellowship in vitamin D Biochemistry at the University of Wisconsin-Madison and received his PhD degree in Nutritional Biochemistry from Virginia Polytechnic Institute and State University, after earning an undergraduate degree in Chemistry from the University of Virginia.

Tony Cruz, Ph.D. Dr. Cruz, age 70, joined the Company in August 2016 as Chief Executive Officer, Transition Therapeutics, Inc., at the time of our acquisition of Transition Therapeutics, Inc., a NASDAQ and TSX publicly traded company. Dr. Cruz had served as the Chairman and Chief Executive Officer of Transition Therapeutics, Inc. from 1998 to 2016. Dr. Cruz co-founded Angiotech Pharmaceuticals Inc., which developed the Taxol-coated stent for cardiovascular restenosis marketed by Boston Scientific. He served as Vice-President of Research from 1991 to 1996 and as a member of the Board of Directors from 1991 to 1995. Dr. Cruz was a founding member and served as the Scientific Director and CEO of the Canadian Arthritis Network, a Network Centers of Excellence. Dr. Cruz has established numerous partnerships with large pharmaceutical companies, biotech companies, and the investment community in the biotech sector over the last 25 years. Dr. Cruz also had a successful academic career from 1987 to 2008 with over 150 publications.

Family Relationships

There are no family relationships among the Company’s executive officers and directors.

CORPORATE GOVERNANCE

Our common stock is listed on the NASDAQ Global Select Market (“NASDAQ”) and trades under the symbol “OPK”. Additionally, our common stock is listed on the Tel-Aviv Stock Exchange. Pursuant to the Company’s Amended and Restated Bylaws and the Delaware General Corporation Law, our business and affairs are managed under the direction of our Board. Directors are kept informed of the Company’s business through discussions with management, including our Chief Executive Officer, Chief Financial Officer, and other senior officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees.

The Company has adopted a Code of Business Conduct and Ethics that applies to all employees, officers, and directors of the Company. The Code of Business Conduct and Ethics is available on our website: www.opko.com under Investor Relations. If the Company makes any substantive amendments to, or grants a waiver (including an implicit waiver) from a provision of our Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, and that relates to any element of the code of ethics definition enumerated in Item 406(b) of Regulation S-K, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we will disclose such amendment or waiver on our website.

Information contained on or accessible through our website does not form a part of this proxy statement and is not incorporated by reference herein.

Director Independence

In evaluating the independence of each of our directors and director nominees, the Board considers transactions and relationships between a director or nominee, or any member of his or her immediate family, and the Company and its subsidiaries or affiliates. The Board also examines transactions and relationships between directors and director nominees or their known affiliates and members of the Company’s senior management and their known affiliates. The purpose of this review is to determine whether any such relationships or transactions are inconsistent with a determination that the director is independent under applicable laws and regulations and NASDAQ listing standards. The Board has affirmatively determined that a majority of our directors, including Messrs. Alexis Borisy, John A. Paganelli, and Richard C. Pfenniger, Jr., and Drs. Richard M. Krasno, Prem A. Lachman, Roger J. Medel, and Alice Lin-Tsing Yu are “independent” directors within the meaning of the listing standards of NASDAQ and applicable law. Mr. Borisy’s term as a director will conclude at the end of the Annual Meeting. In making the independence determinations, the Board considered a number of factors and relationships, including without limitation: (i) Dr. Frost’s and Mr. Pfenniger’s service on the Board of Trustees and Mr. Pfenniger’s service as Vice Chairman of the Executive Committee of the Board of the Phillip and Patricia Frost Museum of Science, an entity in which the Company has contributed an aggregate of $1 million; (ii) Dr. Hsiao’s prior service and Dr. Frost’s and Messrs. Rubin’s and Pfenniger’s service as members of the Board of Directors of Cocrystal Pharma, Inc. (“COCP”), an entity in which Dr. Frost beneficially owns approximately 13%, Dr. Hsiao and Mr. Rubin own less than 1%, and the Company owns approximately 2%; (iii) the joint venture, terminated in January 2022, to which the Company’s former subsidiary, GeneDx LLC and Mednax Services, Inc., a subsidiary of Pediatrix Medical Group, Inc., of which Dr. Medel was a director, were parties; and (iv) the $55,000 donation made by the Company in January 2022 to Dr. Yu’s lab for her lab’s expertise in evaluating compounds which may be effective to treat AR sensitive or triple negative breast cancer.

Board Leadership Structure

The Company is led by Dr. Frost, who has served as Chief Executive Officer and Chairman of the Board since March 2007. Seven of our current directors satisfy NASDAQ independence requirements. Our Board also includes four management directors other than Dr. Frost. The Company has formally identified Mr. Pfenniger as the lead independent director. As lead independent director, Mr. Pfenniger is charged with, among other tasks, presiding over executive sessions of the independent directors, unless a different presiding director is chosen (see “Executive Sessions; Presiding Director” below), serving as a liaison between the Board and the executive management team, and working with the Chairman and management to ensure the Board is able to effectively and independently perform its duties. Independent directors also head each of our Board’s standing committees — the Audit Committee, the Compensation Committee, the Corporate Governance and Nominating Committee, the Independent Investment Committee, and the Succession Committee. Each of the committees is composed solely of independent directors.

Although the Board does not have a formal policy on whether the roles of Chief Executive Officer and Chairman of the Board should be separated, we believe that our current Board leadership structure is suitable for us. The Chief Executive Officer is the individual selected by the Board to manage our Company on a day-to-day basis, and his direct involvement in our business operations makes him best positioned to lead productive Board strategic planning sessions and determine the time allocated to each agenda item in discussions of our Company’s short- and long-term objectives.

Board Diversity Disclosure

As a NASDAQ listed company, we are required to disclose board level diversity statistics. The following table sets forth the relevant information of the current members of the Board.

|

Board Diversity Matrix as of February 29, 2024 |

||

|

Total Number of Directors |

12 |

|

|

Female |

Male |

|

|

Part I: Gender Identity |

||

|

Directors |

2 |

10 |

|

Part II: Demographic Background |

||

|

African American or Black |

||

|

Alaskan Native or Native American |

||

|

Asian |

2 |

1 |

|

Hispanic or Latinx |

1 |

|

|

Native Hawaiian or Pacific Islander |

||

|

White |

7 |

|

|

Other |

1 |

|

|

Two or More Races or Ethnicities |

||

|

Did Not Disclose Demographic Background |

||

None of our directors has identified as non-binary or members of the LGBTQ+ community.

The following table sets forth the relevant information of the members of the Board for the prior year.

|

Board Diversity Matrix as of May 1, 2023 |

||

|

Total Number of Directors |

12 |

|

|

Female |

Male |

|

|

Part I: Gender Identity |

||

|

Directors |

2 |

10 |

|

Part II: Demographic Background |

||

|

African American or Black |

||

|

Alaskan Native or Native American |

||

|

Asian |

2 |

1 |

|

Hispanic or Latinx |

1 |

|

|

Native Hawaiian or Pacific Islander |

||

|

White |

7 |

|

|

Other |

1 |

|

|

Two or More Races or Ethnicities |

||

|

Did Not Disclose Demographic Background |

||

None of our directors included in the foregoing table identified as non-binary or a member of the LGBTQ+ community.

Board Role in Risk Oversight

The Board’s role in the risk oversight process includes receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal and regulatory, strategic and reputational, and cybersecurity risks. In connection with its reviews of the operations of the Company’s business units and corporate functions, the Board considers and addresses the primary risks associated with those units and functions. Our full Board regularly engages in discussions of the most significant risks that the Company is facing and how these risks are being managed.

In addition, each of the Board’s committees, and particularly the Audit Committee, plays a role in overseeing risk management issues that fall within each committee’s areas of responsibility as described below under the heading “Standing Committees of the Board of Directors.” Our Chief Compliance & Audit Officer and his direct report, the Chief Information Security Officer, have primary responsibility for assessing and managing material cybersecurity risks, and report to the Audit Committee on data and cybersecurity matters at least four times a year. The Audit Committee has direct oversight of our data and cybersecurity infrastructure and is the primary governing body that drives alignment on security decisions across the Company. The Audit Committee regularly receives reports from members of senior management, which address the most significant risks facing the Company from a cybersecurity and financial reporting perspective and highlight any new risks that may have arisen since the Audit Committee last met. The Audit Committee also considers and makes recommendations on security policies and procedures, security service requirements, and risk mitigation. The Audit Committee also meets regularly in executive sessions with the Company’s independent registered public accounting firm and reports any findings or issues to the full Board. In performing its functions, the Audit Committee and each standing committee of the Board have full access to management, as well as the ability to engage advisors. The Board receives regular reports from each of its standing committees regarding each committee’s particularized areas of focus.

Meetings and Committees of the Board of Directors

Our Board met five times and acted by written consent on three occasions during fiscal 2023. In fiscal 2023, with the exception of two incumbent directors who each attended 80% of all meetings, all of the incumbent directors attended 92% or more of the Board meetings and meetings of the committees on which they served.

Although we encourage each member of our Board to attend our annual meetings of stockholders, we do not have a formal policy requiring the members of our Board to attend. All then current members of our Board attended our 2023 annual meeting of stockholders.

Executive Sessions; Presiding Director

Our non-management directors meet separately from the Board on a regular basis. Our independent directors meet in executive session from time to time as needed, but not less than twice annually. Our lead independent director generally leads the executive sessions for meetings of the non-management or independent directors. Alternatively, our non-management or independent directors, as applicable, may choose a presiding director by majority vote for each session. The lead independent director or presiding director, as the case may be, would be responsible for, among other things, presiding at the executive session for which he or she is chosen to serve and apprising the Chairman of the issues considered at such meetings.

Standing Committees of the Board of Directors

Our Board maintains several standing committees, including a Compensation Committee, a Nominating and Governance Committee, an Independent Investment Committee, a Succession Committee, and a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act, and the rules and regulations promulgated thereunder. These committees and their functions are described below. Our Board may also establish various other committees to assist it in its responsibilities. Our Board has adopted a written charter for each of its standing committees. The full text of each charter is available on our website at http://www.opko.com.

The following table shows the current members (indicated by an “X” or “Chair”) of each of our standing Board committees:

|

Audit |

Compensation |

Corporate Governance and Nominating |

Independent Investment |

Succession |

|||||||||||

|

Phillip Frost, M.D. |

— | — | — | — | — | ||||||||||

|

Jane H. Hsiao, Ph.D., MBA |

— | — | — | — | — | ||||||||||

|

Steven D. Rubin |

— | — | — | — | — | ||||||||||

|

Elias A. Zerhouni, M.D. |

— | — | — | — | — | ||||||||||

|

Gary J. Nabel, M.D., Ph.D. |

— | — | — | — | — | ||||||||||

|

Alexis Borisy |

— | X | — | — | — | ||||||||||

|

Richard M. Krasno, Ph.D. |

X |

Chair |

— |

X |

X |

||||||||||

|

Prem A. Lachman, M.D. |

X |

X |

X |

Chair |

— | ||||||||||

|

Roger J. Medel, M.D. |

— |

X |

X |

— | — | ||||||||||

|

John A. Paganelli |

X |

— |

Chair |

X |

X |

||||||||||

|

Richard C. Pfenniger, Jr. |

Chair |

— | — | — |

Chair |

||||||||||

|

Alice Lin-Tsing Yu, M.D., Ph.D. |

— | — | — | — | — |

Audit Committee

Our Audit Committee oversees our corporate accounting and financial reporting process. Our Audit Committee met ten times and acted by written consent on one occasion during fiscal 2023. The responsibilities of our Audit Committee are set forth in a written charter adopted by our Board of Directors and are reviewed and reassessed on an annual basis by the Audit Committee. Among other things, our Audit Committee:

|

• |

appoints, compensates, retains, and oversees the work of our independent registered public accounting firm; |

|

| • | approves the retention of our independent registered public accounting firm to perform any proposed permissible non-audit services; | |

|

• |

reviews our systems of internal controls established for finance, accounting, legal, compliance, and ethics; |

|

| • | reviews our accounting and financial reporting processes; | |

|

• |

provides for effective communication between our Board of Directors, our senior and financial management, and our independent registered public accounting firm; |

|

| • | discusses with management and our independent registered public accounting firm the results of our annual audit and the review of our quarterly financial statements; | |

|

• |

reviews the audits of our financial statements; | |

| • | implements a pre-approval policy for certain audit and non-audit services performed by our registered independent public accounting firm; | |

| • | reviews risks relating to financial statements, auditing and financial reporting process, key credit risks, liquidity risks and market risks; | |

| • | discusses policies with respect to risk assessment and risk management and reports to our Board of Directors; | |

| • | establishes procedures for receipt, retention, and treatment of complaints regarding accounting, internal controls, or auditing matters; and | |

| • | reviews and approves any related party transactions that we are involved in. | |

Our Audit Committee is composed of Messrs. Pfenniger (Chairman) and Paganelli, and Drs. Krasno and Lachman. Our Board of Directors has determined that each member of the Audit Committee is independent (as independence for audit committee members is defined in NASDAQ listing standards and applicable Securities and Exchange Commission (“SEC”) rules), and that Mr. Pfenniger is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K.

Compensation Committee

Our Compensation Committee reviews and approves, on behalf of the Board, (i) annual salaries, bonuses, and other compensation for our executive officers, and (ii) employee benefit plans for our employees and executive officers. Our Compensation Committee recommends to the Board for approval, (i) compensation for the Company’s directors, and (ii) incentive compensation plans, equity plans and deferred compensation plans. Our Compensation Committee also oversees our compensation policies and practices. Our Compensation Committee met seven times during fiscal 2023. Our Compensation Committee may from time to time establish a subcommittee to perform any action required to be performed by a committee of “non-employee directors” pursuant to Rule 16b-3 under the Exchange Act and “outside directors” pursuant to Rule 162(m) under the Internal Revenue Code (the “Code”).

Our Compensation Committee also performs the following functions related to executive compensation:

| • | reviews and approves the annual salary, bonus, stock options, and other benefits, direct and indirect, of our executive officers, including our Chief Executive Officer; | |

| • | reviews and recommends new executive compensation programs and reviews the operation and efficacy of our executive compensation programs; | |

| • | establishes and periodically reviews policies in the area of senior management perquisites; | |

| • | reviews and approves material changes in our employee benefit plans; and | |

| • | administers our equity compensation and employee stock purchase plans. | |

The Compensation Committee relies heavily on the recommendations of our Chief Executive Officer concerning compensation actions for our executive officers, other than himself; and the Compensation Committee may engage compensation consultants as it deems appropriate. In deciding upon the appropriate level of compensation for our executive officers, the Compensation Committee reviews, among other things, our compensation programs relative to our strategic objectives and market practice and other changing business and market conditions. To date, neither the Compensation Committee nor management has engaged a compensation consultant in determining or recommending the amount or form of director or officer compensation.

Our Compensation Committee is currently composed of Drs. Krasno (Chairman), Lachman, and Medel, and Mr. Borisy. The composition and functioning of our Compensation Committee complies with all applicable requirements of the Sarbanes-Oxley Act of 2002, NASDAQ rules, and the SEC’s rules and regulations, including those regarding the independence of our Compensation Committee members.

Compensation Committee Interlocks and Insider Participation

Drs. Richard M. Krasno, Prem Lachman and Roger J. Medel and Mr. Borisy served on the Company’s Compensation Committee during fiscal 2023. Mr. Borisy was appointed to the Compensation Committee on June 22, 2023. During fiscal 2023, no member of the Compensation Committee was an officer, employee, or former officer of ours or any of our subsidiaries or had any relationship that would be considered a compensation committee interlock and would require disclosure in this proxy statement pursuant to SEC rules. During fiscal 2023, none of our executive officers or directors was a member of the board of directors of any other company where the relationship would be considered a compensation committee interlock under SEC rules.

Corporate Governance and Nominating Committee

Our Corporate Governance and Nominating Committee’s responsibilities include the selection of potential candidates for our Board, making recommendations to our Board concerning the structure and membership of Board committees, and considering director candidates recommended by others, including our Chief Executive Officer, other Board members, third parties, and stockholders. Our Corporate Governance and Nominating Committee is composed of Mr. Paganelli (Chairman) and Drs. Lachman and Medel. Our Corporate Governance and Nominating Committee met one time and acted by written consent on one occasion during fiscal 2023. The composition of our Corporate Governance and Nominating Committee complies with applicable requirements of the Sarbanes-Oxley Act of 2002, NASDAQ rules, and the SEC’s rules and regulations, including those regarding the independence of our Corporate Governance and Nominating Committee members.

The Corporate Governance and Nominating Committee identifies director nominees through a combination of referrals, including by existing members of the Board, management, third parties, stockholders, and direct solicitations, where warranted. Once a candidate has been identified, the Corporate Governance and Nominating Committee reviews the individual’s experience and background, and may discuss the proposed nominee with the source of the recommendation. The Corporate Governance and Nominating Committee believes it to be appropriate for committee members to interview the proposed nominee before making a final determination on whether to recommend the individual as a nominee to the entire Board to stand for election to the Board. The Committee does not plan to evaluate candidates identified by the Corporate Governance and Nominating Committee differently from those recommended by a stockholder or otherwise.

The Corporate Governance and Nominating Committee recommended to the Board that it nominate each of the director nominees for election at the 2024 Annual Meeting.

Independent Investment Committee